Social Security 2026: 2.8% Boost, Payment Dates, and Why 63 Isn’t the Retirement Sweet Spot

By Maya Carter |

Come January 2026, over 70 million Americans relying on Social Security will see their monthly checks nudge upward by 2.8%, a calculated buffer against the creeping costs of groceries, gas, and utilities that defined 2025’s inflationary pulse. Announced by the Social Security Administration in October, this cost-of-living adjustment—or COLA—translates to an extra $56 on average for retired workers, lifting the typical benefit from just under $2,008 to about $2,064. Yet, as retirees in Florida stock up on sunscreen and those in Michigan bundle against winter winds, a fresh survey reveals a stark disconnect: Most Americans peg 63 as the perfect retirement age, blind to the financial pitfalls that could leave them scraping by decades later. This blend of immediate relief and long-term caution arrives against a backdrop of fiscal tightropes—rising Medicare premiums nibbling at gains, trust fund warnings echoing louder, and a workforce eyeing early exits despite the math screaming delay. With payments rolling out mid-month based on your birthday, 2026 isn’t just another calendar flip; it’s a pivot point for how we redefine security in the golden years.

The COLA formula, tethered to the Consumer Price Index for Urban Wage Earners and Clerical Workers, aims to preserve purchasing power but often falls short for those whose budgets skew toward healthcare and housing. As one advocacy group puts it, it’s like patching a leaky roof with tape—functional, but far from fortified.

Unpacking the 2.8% COLA: Gains, Offsets, and Real-World Math

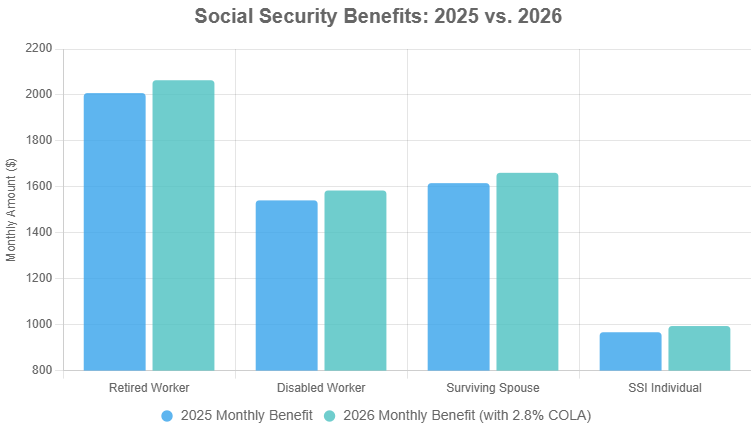

At first glance, 2.8% sounds solid—higher than 2025’s 2.5% hike but shy of the 3.1% decade average. For the average disabled worker, that’s $50 more monthly; for surviving spouses, about $41. Supplemental Security Income recipients, the program’s safety net for low-income elderly and disabled, see maximum payouts climb from $967 to $994 for individuals and $1,450 to $1,491 for couples.

But here’s the rub: Medicare Part B premiums, deducted from most benefits, are slated to jump 11.6% to $206.50 from $185. That swallows nearly the entire COLA for many, leaving net gains razor-thin. Imagine cashing a check buoyed by inflation relief, only to watch it evaporate on doctor visits and deductibles— a scenario playing out for 40 million enrollees.

Eligibility tweaks sweeten the pot for working retirees. If you’re under full retirement age all year, you can earn up to $24,800 without penalty—up from $23,400—before benefits dock $1 for every $2 over. Those hitting full retirement age mid-year get a $65,160 cap, a $3,000 bump from 2025. No more reductions once you cross that age threshold, freeing up side gigs without the clawback fear.

- Payroll Tax Ceiling Rises: The cap on taxable earnings for Social Security taxes edges to $184,500 from $176,100, meaning higher earners contribute a hair more—up to $11,432 annually versus $10,918.

- SSI Advance: Unlike retirement checks, SSI’s first COLA-adjusted payment lands December 31, 2025, dodging January 1’s holiday closure.

These shifts, while incremental, underscore a system straining under longevity: Benefits now support recipients for 20+ years post-claim, per SSA actuaries.

Payment Rollout: When That Extra $56 Hits Your Account

Timing is everything in retirement planning, and the SSA’s birthday-based schedule keeps it predictable—though not without quirks. If your birthdate falls 1st through 10th, expect the boosted check on the second Wednesday of the month; 11th-20th gets the third Wednesday; 21st-31st, the fourth. For January 2026, that’s January 14, 21, or 28, respectively.

SSI folks lead the charge with that December 31 payout, followed by monthly disbursements on the 1st—or the prior business day if weekends intrude. Born on the 1st-10th? Your SSI aligns with the 1st, too. This staggered system, born of 1997 reforms to ease administrative snarls, ensures steady cash flow but demands calendar vigilance—miss a direct deposit glitch, and you’re playing catch-up.

Historical hiccups add context: The zero-COLA years of 2010, 2011, and 2016 left many treading water, fueling calls for reform. Today, with inflation cooling to 2.4% in October 2025, the 2.8% feels like a modest thaw.

The 63 Myth: Survey Says Early Exit, Experts Say Hold Off

Fresh data from the 2024 MassMutual Retirement Happiness Study paints a rosy picture: Most pre-retirees and retirees crown 63 as the “perfect” retirement age, syncing neatly with Social Security’s earliest claim at 62. It’s a vision of freedom—golf tees at dawn, grandkid afternoons without alarm clocks. Yet, the poll’s undercurrent is cautionary: 35% of would-be retirees admit their nest eggs fall short, forcing delays or downsizing dreams.

Why the rush? Cultural cues play in—ads peddle leisure at 60-something, glossing over the math. Claiming at 62 slashes benefits by up to 30% versus waiting till full retirement age (67 for those born 1960 or later), per SSA calculators. At 63, you’re still in penalty territory, locking in lower lifelong payouts amid a trust fund projected to dip into reserves by 2033.

Demographic rifts sharpen the divide: Younger workers, battered by student debt and housing crunches, eye 63 as aspirational; boomers, with pensions fading, cling to it as earned. But experts like those at the Center for Retirement Research warn of longevity risks—34% of pre-retirees fret outliving savings, a valid fear when lifespans stretch to 85+.

Ideal income? The study skirts specifics, but broader benchmarks peg $60,000-$80,000 annually as comfortable for couples, factoring healthcare’s $315,000 lifetime tag, per Fidelity. Delays aren’t just prudent; they’re profitable—each year past 62 adds 8% to benefits, compounding like a savvy stock pick.

Challenges and Reform Echoes: Poverty’s Shadow Looms

Not all bask in the COLA glow. About 10% of seniors teeter in poverty, per Census data, with urban dwellers hit hardest by rent spikes and rural ones by transport woes. Advocacy outfits like The Senior Citizens League decry the CPI-W index as mismatched— it underweights elderly staples like meds (up 8% yearly) and homes. Their pitch: Swap to CPI-E, the elder-focused index, or a “CPI Best” hybrid guaranteeing 3% minimums, plus a $1,400 one-time balm for past shortfalls.

Broader headwinds? The trust fund’s 2033 cliff, if unaddressed, means 21% benefit cuts absent fixes like payroll tax hikes or investment tweaks. Trump’s administration eyes efficiencies, but partisan gridlock stalls bold moves.

Public chatter on X captures the tension: One thread from @RetireSmart55 laments, “2.8% COLA? Medicare eats it alive—time for real reform.” Another, @BoomerBucks, counters: “Claim at 63 and coast; SS is backup, not bankroll.”

Charting the Course: What 2026 Means for Your Wallet

Visualize the COLA’s bite with this snapshot of average monthly benefits pre- and post-adjustment:

This bar chart highlights the modest uplift, but layer in Medicare’s $21.50 premium hike, and the net for many shrinks to pennies.

Forward Glance: Delaying for Dividends in an Uncertain Era

As 2026 dawns, the 2.8% COLA offers a lifeline, not a luxury—enough to cover a tank of gas or a week’s worth of bread, but scant armor against healthcare’s siege. For those eyeing 63, the study’s siren song tempts, yet waiting to 67 could swell benefits by 24%, turning a $2,000 check into $2,480 and staving off that 2033 shortfall.

Policymakers, take note: Reforms like CPI-E adoption or trust fund infusions could bridge the gap, ensuring Social Security endures as the bedrock it was born to be in 1935. For now, beneficiaries, audit your earnings test, sync your calendar for that mid-January deposit, and crunch the numbers—retirement’s not a finish line at 63, but a marathon demanding strategy.

Planning your claim? Tools like the SSA’s Quick Calculator can model scenarios, but for personalized roadmaps, grab our free ebook on “Retirement Reset: Navigating SS in the 2020s” below—insights to stretch every dollar further.